// Rebuilding_Creativity

shopper marketing

The New Advertising Toolkit

I was recently reading a report on WARC about the upcoming trends for the year in advertising and it highlighted 5 key points which I thought summed up the current landscape quite nicely. Whilst digital disruption is still driving alot of the changes we see in organisations today, the lines between “traditional” and “digital” are becoming more and more blurred as we refocus on new omnichannel strategic models and ideas that are channel agnostic. With fresh thinking around the path to purchase as it becomes more connected, the customer experience is becoming more central to the overall marketing strategy then ever. Below are each of the 5 key points from the report that I’ve summarised with a few key take aways.

I was recently reading a report on WARC about the upcoming trends for the year in advertising and it highlighted 5 key points which I thought summed up the current landscape quite nicely. Whilst digital disruption is still driving alot of the changes we see in organisations today, the lines between “traditional” and “digital” are becoming more and more blurred as we refocus on new omnichannel strategic models and ideas that are channel agnostic. With fresh thinking around the path to purchase as it becomes more connected, the customer experience is becoming more central to the overall marketing strategy then ever. Below are each of the 5 key points from the report that I’ve summarised with a few key take aways.

1 BRANDS ARE RETHINKING ‘DIGITAL”

Big-name brands no longer see digital as a separate discipline, and are renewing their emphasis on core brand-building programmes. New strategic models are emerging that work across ‘digital’ and ‘non-digital’ channels

This is more then a back to basics approach though as digital has diversified the suite of brand building techniques available to us. For example media mix modeling analysis has begun to start helping us understand how different combinations of media work together to best effect – WARC showed the example of different ways of combining TV & social media. It’s also expanding our portfolio of responsibilities as companies look for more whole of business innovations such as product or service delivery.

2 ‘SHOPPER’ MERGES WITH ‘MARKETING’

Fresh thinking on the path to purchase, including the role of emotion in the buying process, means that shopper marketing is becoming central to overall strategy.

There are two key reasons driving this shift, firstly technology is obviously changing the way people shop and engage with brands and secondly a growing understanding of the role that emotion plays in the shopping process. Taking these into account, a more sound understanding of the customer journey and the touchpoints along them is critical from awareness to acquisition and repurchase. Brands are beginning to see the value in building this knowledge as more and more of them are taking a customer focused approach to business.This trend towards more targeted customer insight will likely increase as retailers find typical promotions wearing down as sales volumes no longer grow relative to investment.

3 SMARTER CONTENT STRATEGIES ARE NEEDED

As more brands invest in content marketing, competition for eyeballs is growing. Content strategies are diversifying rapidly as brands look to stand out and the number of platforms grows. Sophisticated brands are reformatting content across platforms, and are developing strategies for content ‘discovery’.

Publishers and brands are looking at strategies to diversify their online properties beyond the typical pre roll and banner. Events like the IAB Content Newfronts indicate the new wave of content being created far beyond the typical TVC and show how video content is not necessarily all created equal. Gone are the days of the simple 30sec or 60sec TVC with the options for video content essentially being thrown open it creates new opportunities for creative ways for brands to talk to people along the path to purchase, tailoring the type of content to the situation.

4 THERE IS A BATTLE LOOMING OVER DATA

As investment in programmatic buying increases, sophisticated data strategies will be required. The importance of data management for programmatic is changing the relationship between brands, agencies and tech providers.

This is a really exciting space that allows us to be more effective then ever in refining our targeting and achieving higher conversion by delivering the right message to the right person and the right time. As the path to purchase becomes more connected, once we have an understanding of the customer journey we then have the ability to identify customers early on in the piece and talk to them with relevant information tailored to them and the stage they are at along it. This is not a quick fix solution however and the need for more effective data planning is driving changes for the both brands and agencies.

5 MULTICHANNEL IS A WORK IN PROGRESS

Research into the way channels work together has drawn only tentative conclusions. Some studies underplay social media’s direct impact on sales, but emphasise its importance within a broad media framework. Studies of cross- screen viewing suggest reach is the main benefit, rather than sales synergies.

Whilst research has struggled to quantify the impact of social media on the bottom line, it is generally accepted now that it is most effective as part of a broader strategy. Using social channels help to build up a brands online ecosystem over time help to take advantage of the longer tail of content. The multiplier effect of being exposed to a brand across multiple screens whilst consuming content also can’t be ignored as research shows that people typically watch TV whilst using other “second screen” devices.

Source: WARC Trends Toolkit 2014 – How to keep your brand ahead of the competition. In association with Deloitte.

Author: Alex Leece

The Gen Z Shopper & Participation Branding

I was recently reading an article on Inside Retail about a report on “Gen Z” by Fitch which really crystallized for me a tangible indication of how the face of retail is changing and an insight into how we need to change our communication strategies to suit – in particular around the concept of Participation Branding and creating ideas that make the most of our bought, owned & earned media channels.

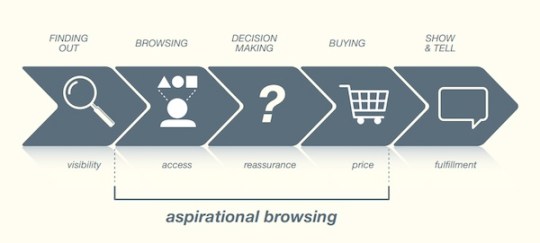

Gen Z, classed as those born after 1995 are hard wired to be cautious of standard marketing ploys and particularly happy to browse before making an informed purchase. A key finding from the report for me was that they demonstrated a “real gap between seeing & buying” enabled mostly by digital platforms such as social media, search or price comparison sites. Essentially the Gen Z shopper can go through a long period of what they termed “Aspirational Browsing” where they may set their sights on products far in advance of actually making a purchase. As agencies this means we need to change the way we communicate as the typical broadcast campaign based methodology is simply not going to be as effective in generating immediate sales with this audience and we need to be present across the omni-channel environment to take advantage of the long tail of our bought, owned and earned media online to ensure we get infront of them at the right time during this extended purchase funnel.

As they said in the report, “It’s all about keeping the brand and potential purchase front of mind during this extended aspirational browse period”. See the below diagram for a visual representation of this process, essentially digital platforms and connectivity enable the consumer to more easily discover, browse, buy and share then ever before.

So how can we overcome or capture the interest of these people during this period of delayed gratification? We have to make sure that our messaging is spread across our digital brand ecosystem through our bought, owned & earned channels so that whilst we will have a big spike in activity across our campaign period, the content lives on so it will be there when and where our Gen Z consumer is browsing or ready to purchase. I recently attended a talk in which the idea of “Participation Branding” was presented, which reflects how we can change our communication strategies to suit this extended period of digital browsing. Participation branding was defined as the below:

“How a brand engages and behaves with consumers across channels and over time to earn their attention and participation through motivating stories and experiences.”

By weaving digital experiences into our campaigns we create an element of interactivity for our ideas which encourages participation by these digitally enabled shoppers. This means that we can actually harness this new shopping behaviour as a positive for our brands and use it spread our message across our brand ecosystem by engaging them through this period of aspirational browsing. In terms of our approach it’s simply just adding another set of tools to our arsenal on top of brand marketing & direct response in the form of social influence marketing:

|

Participation Branding |

||

|

Brand Marketing

|

Direct Response Marketing |

Social Influence Marketing |

By ensuring we use media neutral ideas that propogate digital content and experiences across our bought, owned & earned channels, we start to rally participation and engagement in the brand which builds a digital trail of content or “brand ecosystem” over time. This allows us to take advantage of the long tail of this content by having it live on after the campaigns which means it will be there in the consideration set when the Gen Z shopper is browsing or comparing to make sure we are top of mind – whether it’s during the campaign period or months after when they are looking to purchase. See below a chart from the same presentation which shows how the spikes of campaigns help to build our overall ecosystem over time.

Source: Heather Albrecht of Digital Connections Pty Ltd http://www.digitalconnec6ons.com.au

It’s an exciting time to be in both the retail and communications businesses, the way people consume media and even the way they browse and shop is changing as fast as technology allows. However as long as we continue to create engaging ideas that get infront of the right people at the right time, we will continue to see results – some things never change!

Author: Alex Leece

Mobile & The Automotive Industry

I recently spoke at an IAB NZ Mobile Marketing seminar on our learnings around mobile in the automotive industry and thought I’d write a post on the points I talked to.

I recently spoke at an IAB NZ Mobile Marketing seminar on our learnings around mobile in the automotive industry and thought I’d write a post on the points I talked to.

Vehicles are a high value purchase and as such the research phase of the purchase is quite drawn out, with people consulting many different sources. Online platforms are becoming a large part of this, whether it’s Google, manufacturers websites or various auction sites, people do their research before stepping onto the dealers lot. These platforms are great as they allow us to serve up a depth of information on the cars in a visual and engaging way and deliver experiences that can’t be had anywhere else.

Now there is no doubt that people are adapting to living in a more connected and mobile world and changing their behaviours as such. The old context of someone leaning forward in front of a computer is changing as the new context sees mobile connectivity and a wide variety of devices allowing people to delve in and out of content when and where they want. This is especially prevelant in the automotive industry, as our brands are omnipresent. People are constantly exposed to vehicles driving by, billboards and our above the line advertising, so for people with a keen interest such as influencers and early adopters, any brand exposure could cause them to want to search for information. The mobile is the only device that will always be with them when this occurs. In short, it’s that theory of always on retail – we want people to have a positive experience of the brand when & where they want it.

As expected we have been seeing a marked increase in traffic to our website via mobile over the last 12 months and it’s important to deliver these people the key information they want in an easy to use way that is optimised for the device they are experiencing it on. Whilst mobile is still a fractured market both in terms of hardware and software, there are clearly two stars at this point in iOS and Android, followed by the rest. In terms of development this means you can narrow your focus for crucial platform support. It will be interesting to see how the market evolves and consolidates over time. Much like when the internet was in it’s infancy, once a few players gain scale it will be easier to manage delivering content.

So once we’d identified we needed to be in the mobile space, we began by looking at what were the most important functions for a potential vehicle buyer whilst on the go and identified:

-model information

-booking a test drive

-finding a dealer

-roadside assist

-special deals

We wanted to ensure we were delivering the most important features whilst maintaining a rich experience & depth of information in a mobile optimised format.

To help with conversion even further we can use them to connect people with Mazda and our dealer networks to drive enquiries and test drives.

The recession has caused an increased trend in price competitiveness through incentivised pricing, which has bred a new value conscious shopper who is careful to compare prices to make sure they are getting the best deal. This has meant that people are increasingly comparing prices at the pointing end of the path to purchase and the mobile is the most convenient and ever present device to do this with. This extends to instore comparisons at a dealer level, people may be checking out a car and want to compare another or simply find out further information on the car they are looking at.

Finally, it’s become clear that using digital and mobile platforms we can extend the content available to people across all our other media for qualified leads.

Alex

Big Data & In Memory Computing

Big Data is a term coined to describe the data deluge we are currently experiencing. It’s no secret that we are living in a technology driven society that generates an ever increasing amount of data as we go about our daily lives. “Always on” is a term that is often heard and more often then not, when we are “on” we are creating data about ourselves, our likes and our dislikes, our network of friends both professional and social, and even our travel habits. At the same time, businesses must also retain more and more information to manage themselves more efficiently across the board. In tough economic times there is an ever increasing recognition that organisations must use every single resource at their disposal to get ahead. This results in information and data that once might have been given little attention is now seen as worth its weight in gold if any perceived value can be derived from it.

Looking at the sources of this data, to start with there is of course the sales, operational and customer data that the business collects. On top of this there’s social media data from the likes of Facebook and Twitter including information around friend groups, likes/dislikes and sentiment analysis. There’s web search data, with transactional information or online customer reviews. There’s also data generated by location-based services and data from sensors, moniters and GPS embedded in a growing array of products from vehicles to appliances. I believe if we as advertisors can offer solutions to our clients of how we can process and utilise the growing amount of data available to help inform creative business solutions we could offer real value. To quote a recent Financial Times article

“The challenges are two-fold: First, to recognize the value of big data in mining customer needs and desires, and second, to devise a data management strategy that integrates big data into the front end of the innovation pipeline.”

So how do businesses harness all the data that is being created and use it to inform their strategy and decision making? The challenge here is being able to process large amounts of data at speeds that make it useful. It’s very difficult to really make use of data in business decisions on an ongoing basis when it takes weeks to gather and process. Large software powerhouses such as SAP & Oracle have been bringing new tools to market for businesses to help solve this problem. In memory computing software is designed so organisations can analyse vast quantities of data in near real time across many sources. Essentially in-memory computing takes advantage of a better understanding of how data is formed and housed and the ever decreasing price of memory (discussed in my Technology vs Advertising post). Instead of housing data on a hard drive, data is stored in a computers memory. Therefore, when it needs to be analysed it is available in near real time. This increased power and speed also means that the computers can handle more unstructured data, important when data can come from so many different sources. On the back of this there would need to be a process for managing and delivering the data in an efficient manner and most importantly, in a way that is easy to understand and glean insights from.

Whilst I think caution must be taken not to let our ability to measure granular details bog down the creative process, at the end of the day, the more you know about your customers and can integrate those insights into your business strategies the more likely they are to improve revenue, margins and market share. Who wouldn’t want that leg up over the competition?

Alex

The Continuous Channel – The New Retail Frontier?

I recently watched a presentation by Steve Nave, former SVP & General Manager of Walmart.com and in it he raised the concept of the continuous channel as a new frontier for retailers. He talked about rather than seeing retail as a multi channel process, we should be taking a step back to look at the entire brand, letting customers shop the way they want to shop and bringing it all together into one continuous channel. Essentially instead of serving customers through individual channels, we serve them at touch points across channels by optimising the organisations processes and technologies. The picture on the left is a trial advertising program by Tesco in South Korea. In a “virtual store” concept, people could shop with their mobile phones whilst waiting for a train directly from an ambient installation set up to look like a store and have their groceries delivered to their home hours later. This is a great example of allowing shoppers to purchase in new ways, on their terms and across channels.

I recently watched a presentation by Steve Nave, former SVP & General Manager of Walmart.com and in it he raised the concept of the continuous channel as a new frontier for retailers. He talked about rather than seeing retail as a multi channel process, we should be taking a step back to look at the entire brand, letting customers shop the way they want to shop and bringing it all together into one continuous channel. Essentially instead of serving customers through individual channels, we serve them at touch points across channels by optimising the organisations processes and technologies. The picture on the left is a trial advertising program by Tesco in South Korea. In a “virtual store” concept, people could shop with their mobile phones whilst waiting for a train directly from an ambient installation set up to look like a store and have their groceries delivered to their home hours later. This is a great example of allowing shoppers to purchase in new ways, on their terms and across channels.

Traditionally there were only three channels which organisations could utilise to actively generate sales, the stores themselves, direct sales (phone/direct marketing) and printed catalogues. These channels essentially each only had a single touch point within them. This has now all changed with the advent of the internet and the establishment of ecommerce as a legitimate channel. The internet differs from the three traditional channels in that it doesn’t simply create one touch point but a vast array of new ones. It feeds emerging technologies as it expands into mobile, tablet, TVs, instore, cars and not to mention social media. The key thing to note here is that when you think about it, none of these new touch points are actually a new channel in themselves, they are all being fed by the existing internet channel. The opportunity here for retailers is that increasingly everything is becoming a touchpoint with which consumers can transact with your organisation. Whilst this may sound similar to the concept of multi-channel retailing, the difference is in the thinking of how the channels and touch points intersect together and how the organization responds to the customer across them to drive sales.

For this to work, information, and data must flow freely between channels on the customer end and within the business units of the organisation, no silos. Customers more and more expect to be able to shop across channels, for example purchasing an item via mobile and collecting it instore. They need to be able to shop when and how they want to, customers shop with your company as a whole, not with an individual channel. With this in mind we can look at new ways to intersect them. I think whilst it may be very hard to truly get to a point where this is fully achieved but it is a good journey to be on and will help drive retailing into the future.

The Walmart example that Steve discussed is a good one to look at in terms of a big retailer testing out initiatives which cross the channel boundaries. Walmart has implemented the below strategies with their ecommerce platform that go some way to letting the customer shop their way and intersects both instore and internet enabled channels:

Site to Store – customers could purchase products online and have them sent to their local store for collection.

Pick Up Today – customers can view a stores stock online, purchase and put it on hold knowing it’s ready for them when they arrive in store to collect it.

Scheduled Delivery From Store – customers can order something online from a store and schedule the delivery for when they want it to arrive at their home.

These strategies are interesting in not only do they cross the typical “channel” boundaries, but really add utility for the customer.

Looking forward, Steve identified the below future milestones he thought to be criticial to driving the continuous channel strategy going for Walmart:

–Social – not just in a setting up a Facebook page way but really looking at what the intersection is between business and social. They started an initiative called “Walmart Labs” to explore new technology around understanding what people are talking about in social media. With that insight, then as brands we can come to people and be relevant to them and the local community TODAY in new ways. For example we could use the information to influence what store staff talk to customers about when they enter the store, the POS instore, or what new initiatives stores can do for people. It’s about more then just sending emails of a relevant sale to people who have indicated they like blenders on Facebook.

-Mobile – This will help drive the continuous channel as a future for ecommerce. Customers are turning to mobile devices more and more for information when they want it quickly. To help keep pace in this area, Walmart are going so far as acquiring tech company start ups to remain agile and take advantage of the latest advances in technology.

-New Store Models – Can ecommerce begin to help influence store layout? Walmart are now siting the online division at the table when discussing how stores are designed to help bring online into the bricks and mortar channel. For example we don’t necessarily need the store floor space to show all products if we can back it up with online channels. For example you could show just 3 digital cameras in each price point, knowing 300 more are online which we can get to store for someone today, or to their home.

Whilst we won’t see the end of bricks and mortar stores, customers will always have something to do instore, (a point I touched on in my post Why Bricks and Mortar Stores Will Always Have a Role to Play) retailers will need to rethink their operational strategy to keep up with how consumers expect to be able to shop, on their terms, across channels.

Alex